Car Allowance Rebate System (CARS) : Overview

May 29, 2023 By Kelly Walker

With over 690,000 automobiles traded in and almost 700,000 reimbursements granted, the Car Allowance Rebate System (CARS) was a huge success. The program ran from July 1 to August 24, 2009, and the money provided was depleted in less than a month. Because the program was so successful, Congress granted an additional $2 billion in financing to prolong it, which was consumed by the end of August.

The Car Allowance Rebate System (CARS), popularly known as "Cash for Clunkers," was a United States government program that attempted to boost the car industry and encourage customers to buy more fuel-efficient automobiles. The program was highly successful and piqued the curiosity of both consumers and the automobile industry.

The (CARS) was designed to meet specific requirements. The trade-in car has to meet certain criteria, including being less than 25 years old, being in operable condition, and getting at least 18 miles per gallon on the highway. The new vehicle purchased had to have a combined fuel economy of at least 22 miles per gallon for cars or 18 miles per gallon for trucks and SUVs. The rebate amount varied depending on the difference in fuel efficiency between the trade-in vehicle and the new vehicle purchased. The rebate was $3,500 for a new car at least 4 miles per gallon more efficiently than the old vehicle or $4,500 for a new car at least 10 miles more efficiently.

How Does the Car Allowance Rebate System (CARS) Work?

The Car Allowance Rebate System (CARS) was successful in encouraging people to upgrade to more fuel-efficient vehicles by offering rebates on the purchase of new automobiles. The program was designed to encourage consumers to make more environmentally friendly choices and to help reduce the overall carbon footprint of the U.S. vehicle fleet.

To participate in the program, consumers had to bring their old vehicle to a participating dealership and purchase a new, more fuel-efficient model. The dealership would then complete the necessary paperwork and submit the information to the government for processing. The consumer would receive a rebate check in the mail within 4-6 weeks.

The rebate amount determined the fuel efficiency difference between the purchased old and new vehicles. The program was designed to be simple and easy to understand, with a clear set of requirements and guidelines for consumers and dealerships. Participating dealerships had to adhere to strict reporting and record-keeping requirements to ensure the program was administered fairly and effectively.

In addition to providing a financial incentive for consumers to purchase more fuel-efficient vehicles, the (CARS) also had several other benefits. The program helped to stimulate the automotive industry and boost sales of new vehicles during a challenging economic period. It also helped to reduce the overall carbon footprint of the U.S. vehicle fleet and encouraged automakers to develop new technologies and innovations that would further improve fuel efficiency.

Eligibility Criteria for Car Allowance Rebate System (CARS)

To be eligible for the (CARS) program, there were specific criteria that the trade-in vehicle and the new vehicle had to meet. Firstly, the trade-in vehicle had to be under 25 years old, in drivable condition, and have a combined fuel economy of 18 miles per gallon or less. Secondly, the new vehicle purchased had to have a combined fuel economy of at least 22 miles per gallon for cars or 18 miles per gallon for trucks and SUVs.

Additionally, the trade-in vehicle had to be titled and registered to the same owner for at least one year before the trade-in date. The new car purchased must also be a new, unused vehicle and cost less than $45,000. Furthermore, the program was only available to consumers, not businesses or fleets.

Requirements of the Car Allowance Rebate System (CARS)

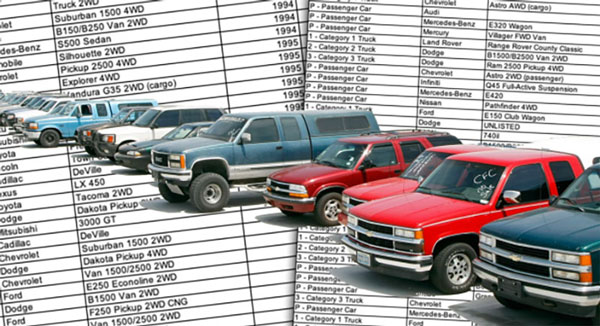

The several requirements of the Car Allowance Rebate System (CARS) that consumers and participating dealerships have to follow. One of the most crucial requirements was that the trade-in vehicle had to be destroyed, and the dealership had to provide proof of destruction to the government. This requirement aimed to ensure that the less fuel-efficient vehicles were taken off the road and not resold.

Participating dealerships also had to register with the program and complete the necessary training to be eligible to participate. Dealerships were required to provide accurate and complete information about the trade-in vehicle and the new vehicle purchased, including make, model, year, and vehicle identification number (VIN). Additionally, dealerships had to submit all required paperwork within ten business days of the sale to receive reimbursement for the rebate amount.

Consumers also had to be aware of the requirements of the program. They had to ensure that their trade-in vehicle met the eligibility criteria and that the dealership participated in the program. They also had to provide the dealership with all the necessary paperwork and information about the trade-in vehicle.

Rebate Amounts for Car Allowance Rebate System (CARS)

The rebate amount for the (CARS) varied based on the difference in fuel efficiency between the trade-in vehicle and the new vehicle purchased. If the new vehicle had a combined fuel economy of at least four miles per gallon more than the trade-in vehicle, the rebate amount was $3,500. If the new vehicle had a combined fuel economy of at least ten miles per gallon more than the trade-in vehicle, the rebate amount was $4,500.

The rebate amount was also subject to adjustment based on the type of vehicle being purchased. For example, consumers who purchased a new vehicle with a combined fuel economy of at least 18 miles per gallon for trucks and SUVs were eligible for a $3,500 rebate, regardless of the difference in fuel efficiency between the trade-in vehicle and the new vehicle purchased.