Interest-Only Retirement: Can It Be Done

Feb 16, 2023 By Kelly Walker

Regarding retirement planning, having control over your finances is key. But with so many options and strategies out there, where do you start? One strategy gaining steam in the industry is interest-only Retirement—the practice of using only the income from investments for living expenses during Retirement.

But can this offer retiring individuals a stable financial future? Today's blog post will explore how interest-only retirement works, the potential benefits and risks involved, and whether it could be an effective approach to your financial goals after leaving the workforce. Read on to learn more!

What is interest-only Retirement, and how does it work?

Interest-only Retirement is a strategy that relies solely on the income generated from investments for living expenses during Retirement. It involves making interest payments on the principal to ensure that the borrowed amount stays stable and does not increase due to compound interest.

It is an effective strategy for those looking to maximize their retirement savings and minimize the income tax they pay as they retire. It also helps to reduce the risk of outliving one's savings by allowing the investor to maintain more of their principal balance throughout Retirement.

Individuals must choose appropriate investment vehicles and diversify their portfolios to maximize returns when implementing an interest-only retirement strategy. It is also important to consider the impact inflation will have on your investments over time, as this can erode the purchasing power of your savings.

Interest-only Retirement can be a great way to ensure you have enough money saved for Retirement and maintain a steady income stream even after leaving the workforce. However, it's important to consider all the potential risks and benefits before committing to this strategy.

It's important to consult a financial advisor to ensure you have chosen an appropriate investment plan that meets your individual needs. This way, you can be sure you are making the most of your retirement savings while keeping risk to a minimum.

The benefits of interest-only Retirement

Interest-only Retirement is an increasingly popular strategy for those seeking stability during their golden years. Through this approach, retirees receive only the income from their investments, such as interest from bonds and stock dividends, to cover living expenses. While this may seem daunting for some, a few potential benefits could make it worth considering.

First:

the interest-only retirement approach allows retirees to maintain access to their capital and grow it over time if invested wisely. On the other hand, taking a lump-sum distribution from an IRA or 401(k) could result in taxes being owed on the entire sum.

Second:

with interest-only Retirement, retirees can manage their investments to suit their individual needs and goals. For instance, they can decide which investments are right for them and when to sell or buy more. This gives them greater control over their finances than relying solely on a pension plan.

Third:

retirees can reduce the overall amount of taxes paid during Retirement by using interest-only Retirement. By only drawing income from investments that generate taxable income like bonds and dividends, retirees may be able to delay paying taxes until later in life when their tax rate is lower.

Finally, with interest-only Retirement, retirees can better prepare for unexpected expenses that arise during Retirement. By keeping their capital intact, they will have access to funds in case of a medical emergency or other need.

Overall, interest-only Retirement can offer various advantages to those looking for stability and control over their financial future during Retirement. While it's not right for everyone, it could be an effective strategy when used properly and combined with other strategies like pensions and Social Security.

If you're considering this approach, research and speak to a qualified financial advisor before making any decisions. With the right guidance and preparation, you can secure your financial future.

The drawbacks of interest-only Retirement

Interest-only Retirement may sound like a great way to secure your financial future, but it's important to understand the drawbacks before jumping in.

The biggest issue with interest-only Retirement is its need for more flexibility. You can only access the income from investments, which means if you need more money than the amount you have to withdraw, you're left with few options.

Another major downside is its reliance on stock market performance. Since your investments will be working for you using only interest income, any negative swings in the stock market can significantly reduce your retirement funds. You also risk running out of money if the rate of return on your investments fails to meet expectations.

Interest-only Retirement also means that you must manage and monitor your portfolio closely. If you don't stay up-to-date on changes or shifts in the markets, it could drastically affect your current financial situation and the future of your retirement savings.

It's important to note that interest-only Retirement can be a great option for some people, but it's only right for some. Before taking the plunge and opting for this approach, it's critical to consider all the risks involved—not just the potential rewards.

The bottom line is that interest-only Retirement is more than just a one-size-fits-all solution; this strategy has advantages and drawbacks. It may be effective if you have the resources to monitor and manage your portfolio closely, but otherwise, it could put your financial future at risk. Ultimately, it pays to research before making big decisions about how to handle your retirement planning.

How to decide if interest-only Retirement is right for you

Interest-only Retirement is a strategy that has the potential to provide greater financial security in Retirement. It involves using only the income from investments to cover living expenses during Retirement while leaving the original investment intact.

Although interest-only Retirement may sound appealing, it is important to consider all variables before committing to this approach. First and foremost, you should assess your financial goals and lifestyle needs in Retirement. Do you prefer a riskier portfolio with higher returns or a more conservative approach with lower returns?

Additionally, consider how much income you need to cover living expenses during Retirement. If the funds available through interest-only Retirement are not enough to meet your needs, then it may not be the right choice.

It is also important to understand the potential risks associated with this strategy. If the investments used to cover living expenses during Retirement are not managed appropriately, it could lead to losses that reduce the total amount available for your Retirement.

Additionally, any changes in the market or economic conditions could impact your financial stability because you will be relying on interest-only income.

Finally, you should weigh your options carefully and compare them to other strategies, such as traditional retirement planning. Traditional retirement plans offer a safer approach because they typically involve investing in various assets to increase your savings over time steadily.

Ultimately, it is important to understand all the benefits and risks associated with interest-only Retirement before deciding. Consider all of your options carefully and seek the advice of a trusted financial professional before committing to this approach.

With proper planning, interest-only Retirement could be an effective way to secure your financial future in Retirement.

Can Interest only Retirement be done?

It's certainly possible to have a secure financial future in Retirement with an interest-only approach, but there are some important considerations to keep in mind.

You should seek professional financial advice and research different options before deciding how to approach Retirement financially. While an interest-only retirement strategy can provide a more flexible approach to retirement income, it also carries some risks.

Understanding how your investments will perform if the stock market or interest rates change over time is important. Additionally, it would help if you considered how long you plan to remain in Retirement, as inflation can reduce the purchasing power of your nest egg over time.

Ultimately, interest-only Retirement is a personal choice, and the decision should be based on a comprehensive understanding of your retirement plans. With careful planning and preparation, an interest-only strategy can help you enjoy financial security and stability in Retirement.

Evaluating different options thoroughly can help ensure you make the best decisions for your unique financial goals. It's important to take the time to understand the risks and rewards of any retirement strategy before committing. Considering all angles, you can make informed choices that will help set you up for financial success throughout your Retirement.

FAQS

What are some common mistakes people make with interest-only retirements?

One common mistake is underestimating how long they will live in Retirement. This often leads to people withdrawing too much money from their investments too soon and running out of money before the end of their Retirement.

Another mistake is needing to understand how to diversify an investment portfolio properly. Not spreading investments across different asset classes can lead to a less-than-optimal return on investment.

Finally, many people need to calculate their annual expenses correctly. They may need to pay more attention to the cost of healthcare and other items that can increase as we age.

What are some other options for retirement planning?

Regarding retirement planning, there is a wide range of options available. Depending on your risk tolerance, income needs, and financial goals, you can use a 401(k), 403(b), IRA, or another investment account.

Alternatively, you may supplement your retirement income by using annuities, CDs, and other fixed-income investments. No matter which retirement planning option you choose, it's important to understand each option's potential benefits and risks.

How much interest should I count on for Retirement?

It's important to calculate how much interest you can count on for your Retirement before deciding to pursue an interest-only retirement plan.

The amount of money you can count on for your Retirement depends on various factors, including the type of investments you make and how long you plan to invest.

For example, if you are investing in stocks, you can expect higher returns than investing in bonds or cash.

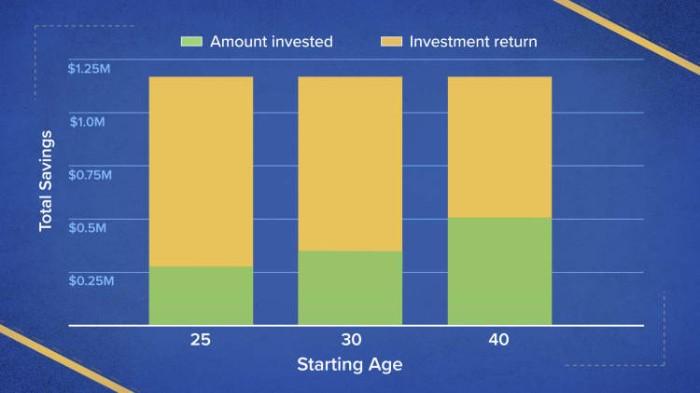

Additionally, the longer you invest, the more time your investments have to grow and compound, which could lead to higher returns on your investments.

It's also important to consider other aspects of retirement planning, such as creating a budget and understanding the risks associated with your investments.

Conclusion

In conclusion, Interest-Only Retirement is an exciting and viable possibility for those who want to retire comfortably with their current income. When managed responsibly, it can be a powerful tool to help you accumulate wealth and increase your asset portfolio faster than traditional retirement plans.

However, weighing the risks associated with this retirement strategy against its potential rewards is important. Careful planning and understanding the financial implications are key to deciding whether or not Interest-Only Retirement is right for you. If you still need to decide whether or not it's suitable for you and your circumstances, we advise you to reach out to a financial planner or consult a professional who can offer sound guidance.

Ultimately, the decision is yours, but information gathered from trusted sources can help give you confidence when deciding about Interest-Only Retirement: Can It Be Done?